Be careful that which you signal: Ontario son attacking for home immediately after personal home loan went completely wrong

Attorneys to possess Morex Investment states business willing to work with Christian Brooks, 49, to cease forced purchases out of domestic

A , Ont., guy is actually unable to retain the house in which he could be stayed having 15 years shortly after he signed to a high-desire financial which have a personal lending company that is today desire him into the judge for perhaps not to make money.

Mississauga-depending Morex Money initiated judge process the 2009 year to take control of the house because of electricity regarding selling, but provides since the changed tack shortly after CBC Information first started inquiring concerns towards condition.

Their attorney today says it is prepared to discuss with 49-year-old Christian Brooks to attenuate the total amount owing towards $195,one hundred thousand mortgage who may have ballooned to help you $248,100000.

Brand new self-employed artwork designer got a minimal credit history, debts to blow and you will a stuff agency is actually shortly after your. Tax statements inform you his annual earnings at the time was slightly more than $7,100, leaving out deals.

These mortgage – funded because of the private investors that have pooled money to give finance in return for an income to your money – happens to be usual in Canada. Borrowers should be aware, it has been not susceptible to the same kind of lending conditions because the a timeless mortgage given by an excellent chartered lender.

Home loan sent % rate of interest

An acquaintance introduced your in order to Morex Financing, a friends one invests from inside the “higher producing, short-name first and second home-based Ontario mortgage loans,” based on their site.

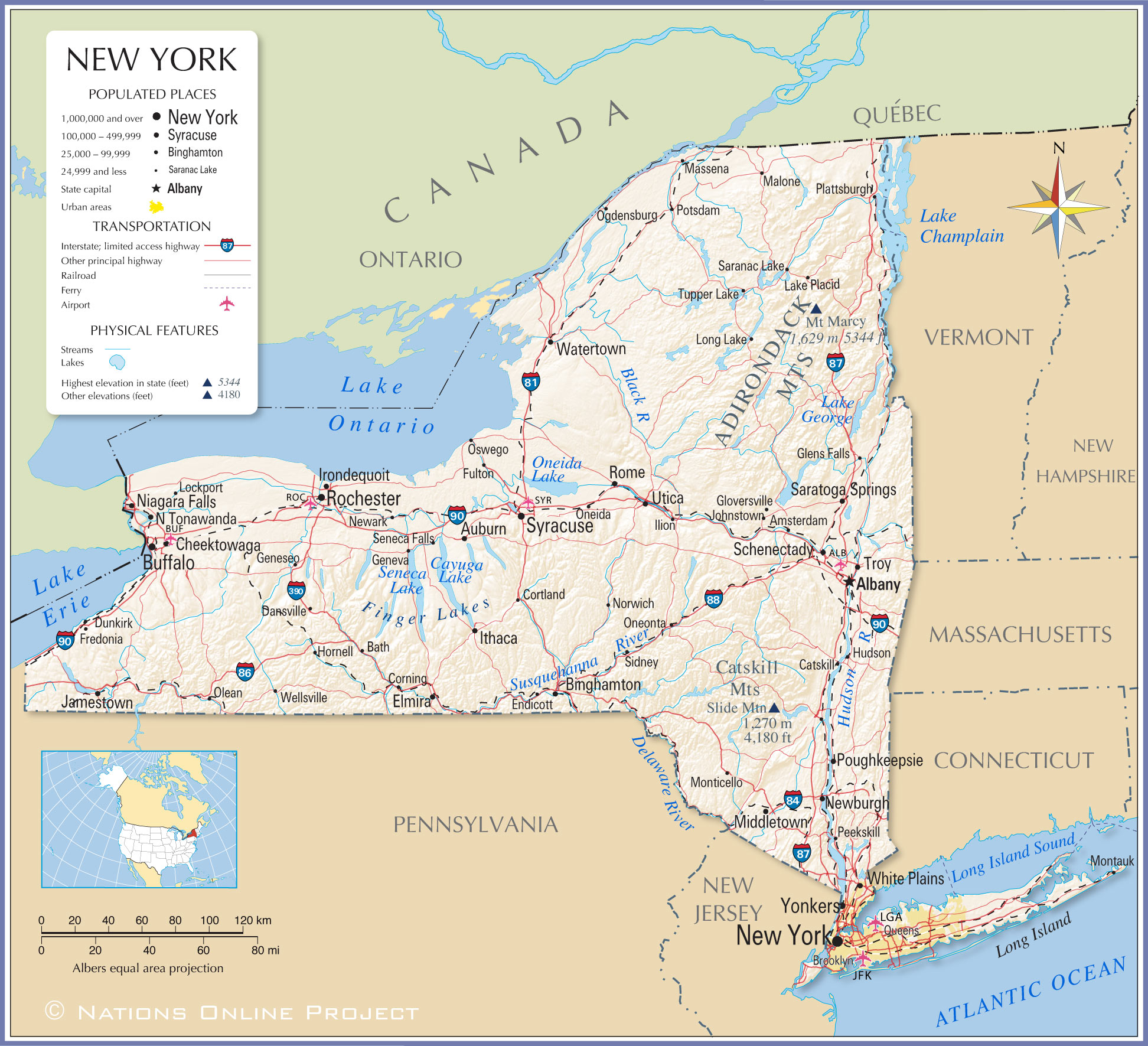

Brooks was not purchasing the isolated bungalow into the Cheeseman Push, they currently belonged so you can their granny. Brooks says he had been primarily elevated of the the girl features stayed by yourself at the domestic given that she gone to live in a nursing house previously.

He or she is a joint-tenant for the label, meaning however inherit the home up on their grandmother’s death, and also power of lawyer on her behalf assets, that he always signal on her.

From inside the , Brooks got out a loan resistant to the $800,one hundred thousand domestic in the form of a one-seasons, $195,100 home loan having a per cent interest, according to signed mortgage partnership examined because of the CBC News.

With regards to the home loan document, this new costs included an excellent $31,000 percentage so you’re able to an individual who Brooks says he will not know, an enthusiastic $8,100000 government percentage, a good $4,100000 representative fee and a yearly revival commission as much as $8,one hundred thousand, with other prospective charges for late costs and you will lawyers from inside the matter-of standard.

“I agreed to they by situation I found myself into the,” he said. “I got zero alternatives but for taking they as I became already in credit card debt.”

He states their purpose were to generate straight back their borrowing from the bank, upcoming check out a bank and also have a personal line of credit having a lower life expectancy interest rate.

Brooks says the guy generated attention-only money of about $step 1,700 through pre-authorized debit per month for a few years instead of incident and you can says Morex failed to contact him up to – 2 yrs adopting the 1st agreement – in order to replace the loan.

The guy closed a home loan revival agreement one to month, including $16,100 inside renewal charge having 2020 and 2021 becoming paid off upfront. Whenever Brooks would not spend this much at once, he states the firm presumably avoided recognizing their monthly premiums within the and it has would not cash cheques he then considering.

Morex Financing initiated strength-of-marketing legal proceeding when you look at the January, trying take control of the house and you will stop Brooks out, centered on a statement out of claim filed for the good Newmarket courtroom.

Morex alleges on the say that Brooks is during default and private student loans for medical school you will the guy owes $248, – a price filled with the loan dominating, notice, missed repayments, late charge, judge will cost you and a host of most other fees. That is in addition $40,800 Brooks already paid-in attention.